Explain the Difference Between Hmo and Ppo

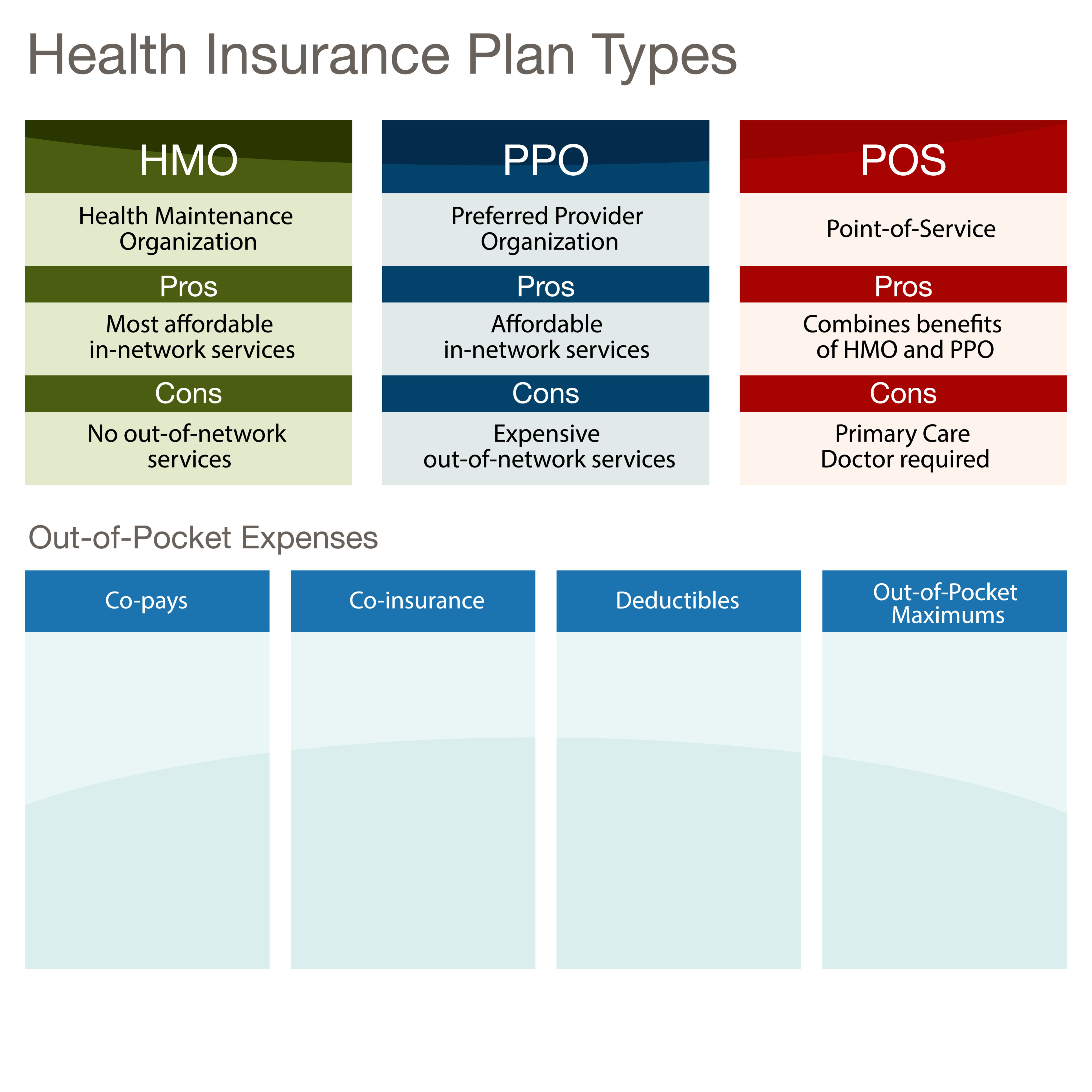

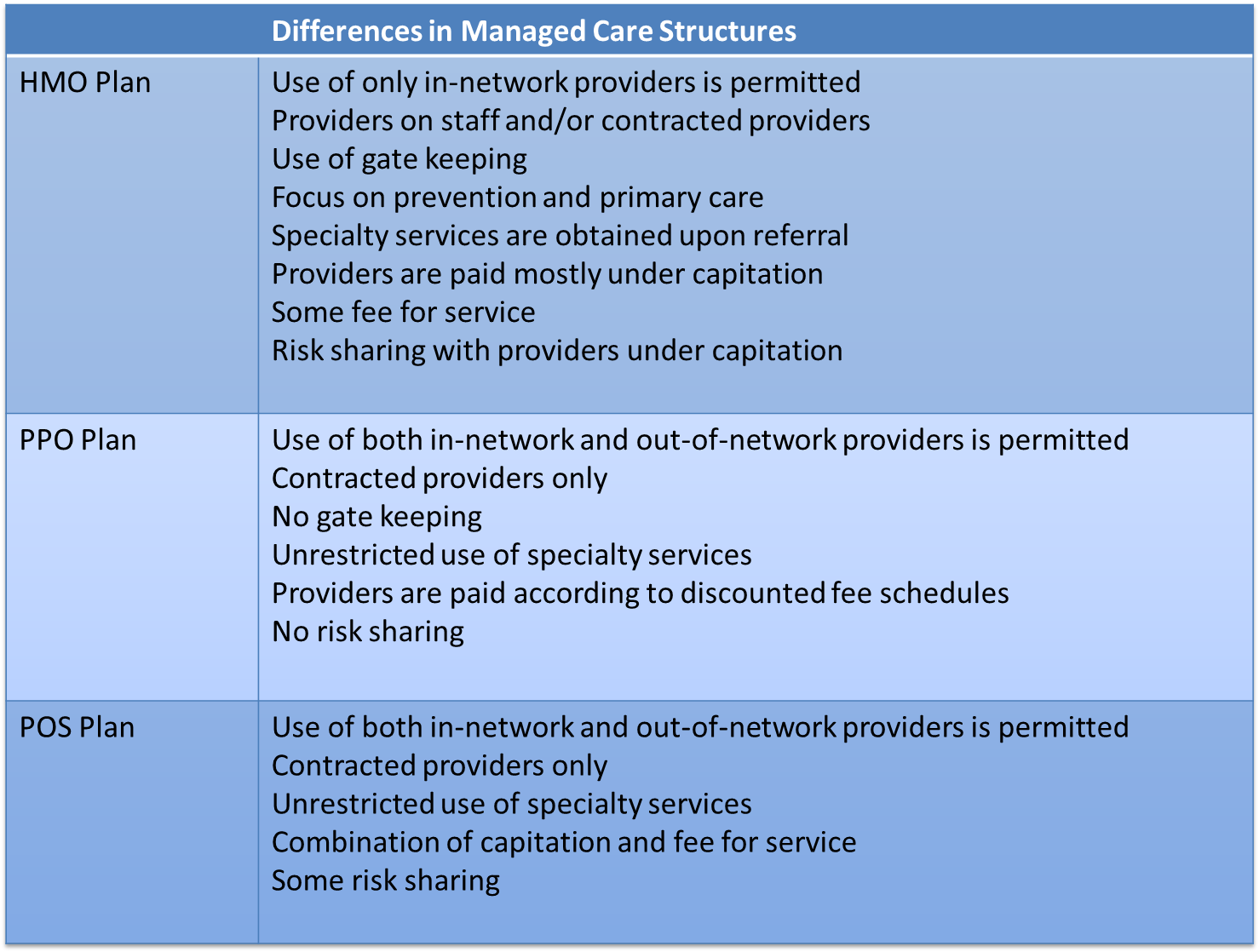

To start HMO stands for Health Maintenance Organization and the coverage restricts patients to a particular group of physicians called a network. Like an HMO plan a PPO insurance plan provides a patient with a network referred to as a PPO network of health care providers and hospitals.

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What is a Medicare PPO.

. Dont worry we explain the major differences between HMO and PPO to help you decide which plan is best for your current health care needs. 2 HMOs and PPOs are both types of managed care which is a way for insurers. As mentioned above Differences between HMO Health.

2 level 2 Le_Bish 8y. Interestingly the difference in HMO and PPO came to limelight as a result of unending calls for healthcare providers to review their premiums. There are other fantastic features in HMO and we would try as much as possible to point them out in due course.

PPO universe is how an enrollee in one of these plans chooses and sees their doctors hospitals and other providers. Now that you know a bit about choosing between PPO vs HMO healthcare it should be easier to understand which plan will work best for you. PPO planstypically have higher monthly premiums than HMO plans.

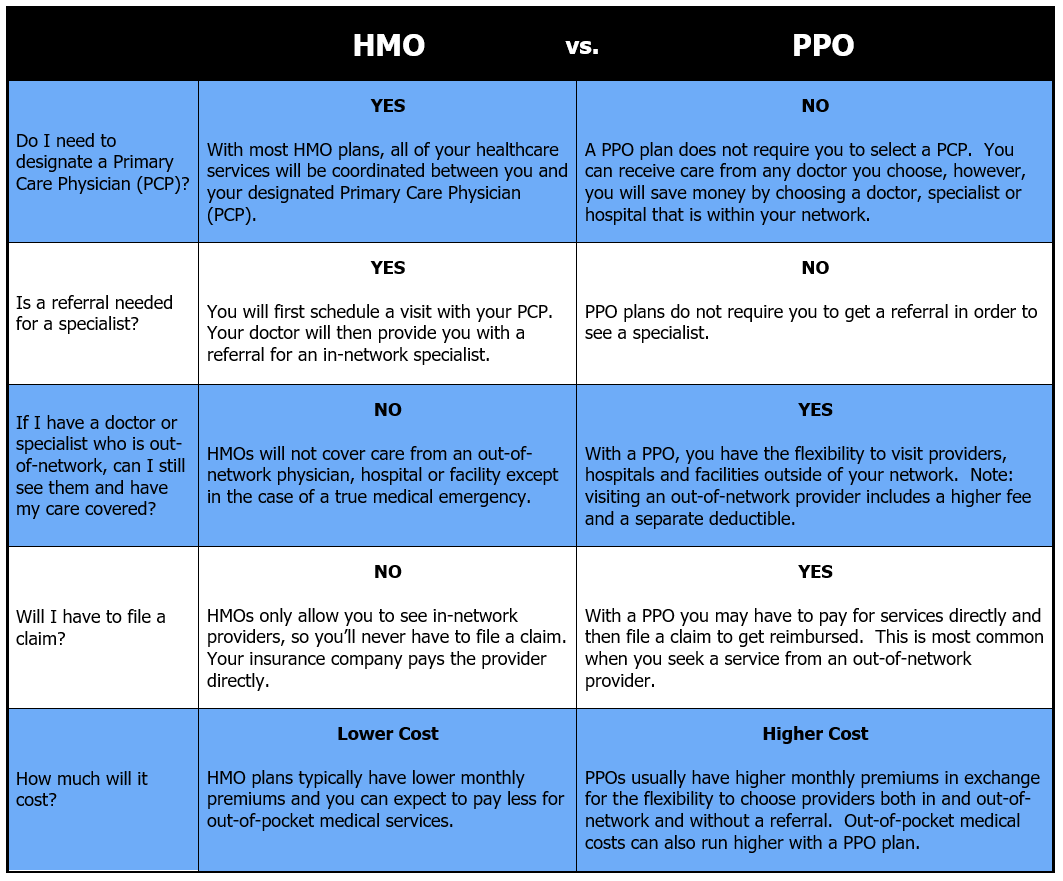

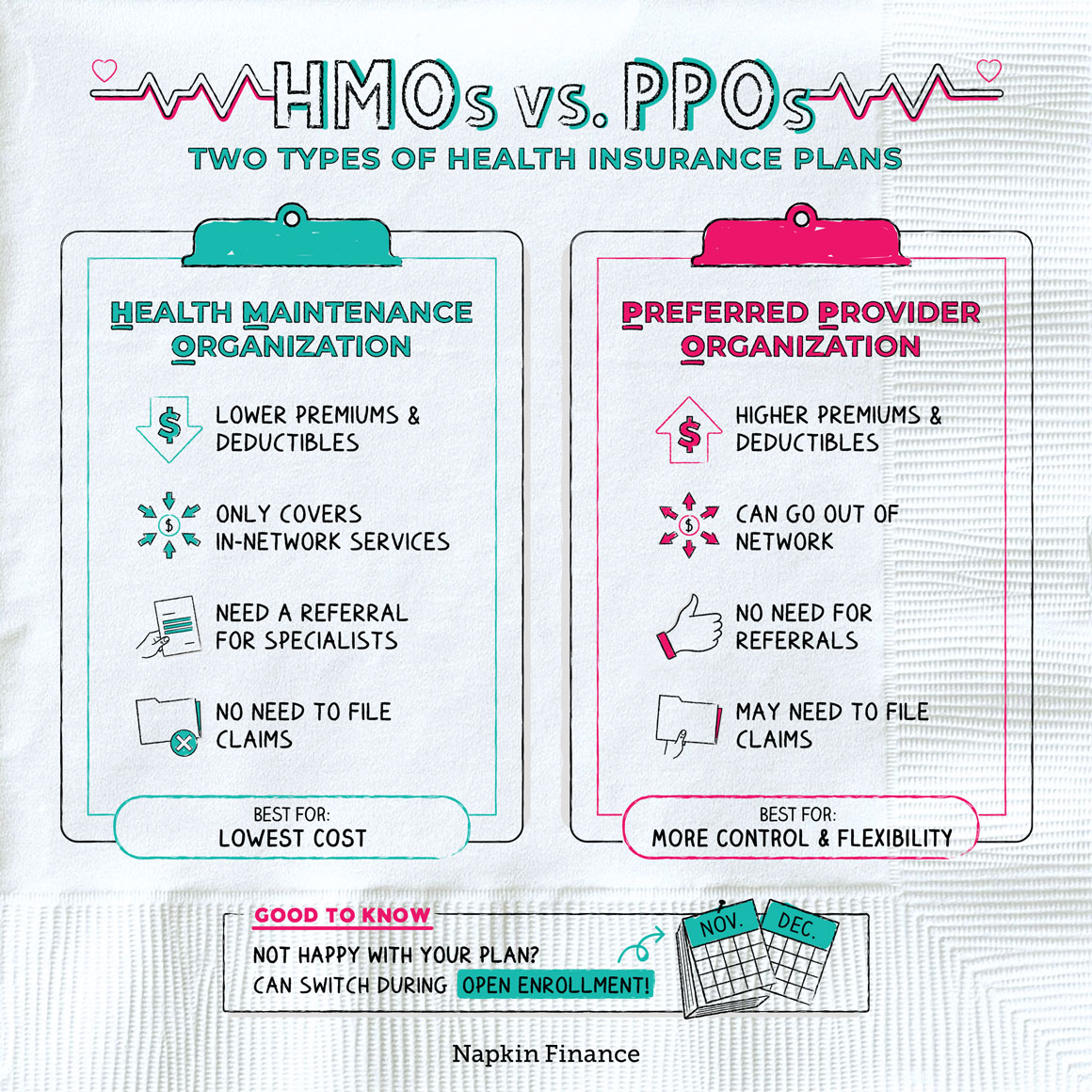

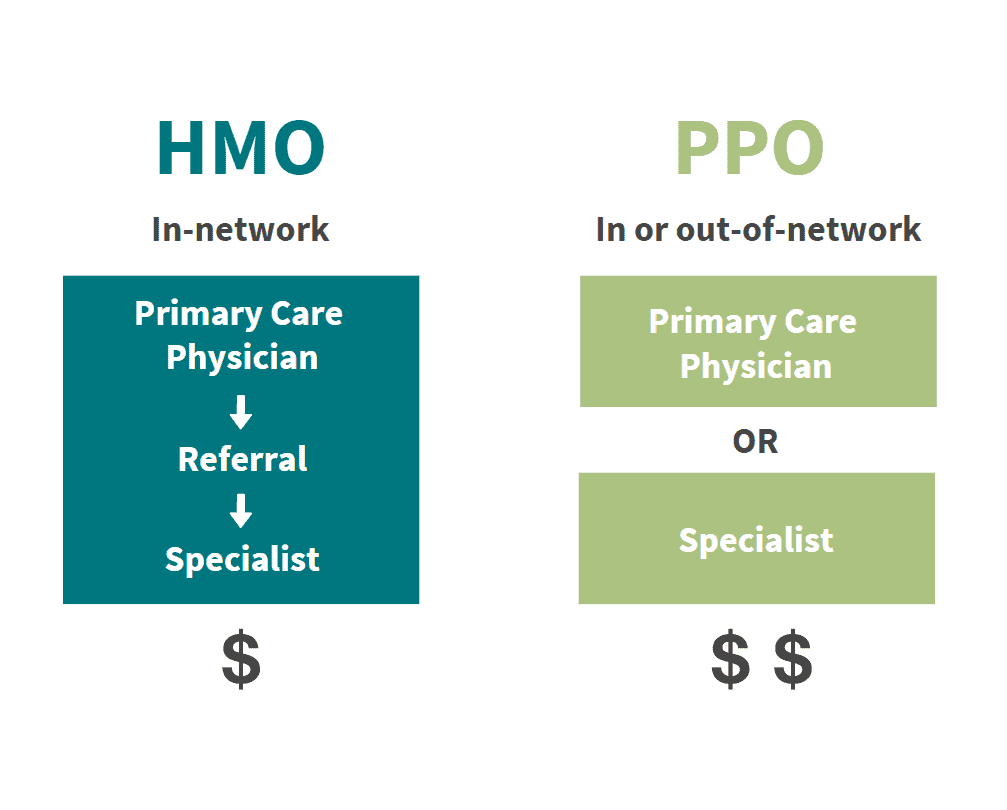

A PPO gives you more freedom to chose what doctors you see. A PPO is when you get to pick an chose your doctor and they help pay. HMOs and POS plans require a primary care physician and referrals while PPO plans do not.

There are a few key differences between HMO and PPO plans. You have to see their doctors and follow their rules. The biggest difference in the HMO vs.

With a PPO patients can see any doctor they wish or visit any hospital they choose usually within a preferred network of providers. The difference between HMO or Health Maintenance Organizations and PPO or Preferred Provider Organization is that unlike HMO under PPO the employees have the liberty to consult a doctor of their choice without the fear of footing the whole bill. A PPO plan is a good choice if you.

HMO deductibles are usually smaller than PPO deductibles but either can still run thousands of dollars a year if you have serious medical issues. Payment is higher if chosen from the list. Both HMOs and PPOs offer similar coverage but there are some significant differences between coverage and costs.

An HMO gives and individual access to particular hospitals and doctors within their network An. If you are considering an HMO vs a PPO these are the main differences to keep in mind. HMO and PPO are two famous managed health programs in the United States for employees.

The PPO offers choice and flexibility but is often more expensive. PPO and HMO comparison chart. This plan also lets the patient coordinate their care and manage which providers they would like to see.

It is a norm in the. Jones I will be more then happy to explain to you what is the difference between PPO plan and HMO plan and which one I would recommend but first let me explain what are the difference of an HMO plan. PPO plan is only covered if a doctor you chose is within the providers network.

Are often out of your providers area of medical coverage. How much you have to pay if you see a provider who is out of network. HMOs have a list of doctors you can go to who theyve organized rates with and you cant go to a specialist without getting a referral from your primary care physician.

They prefer you to choose from list of providers. 4 Preferred Provider Organization PPO A preferred provider organization PPO offers reduced costs if you use the network of physicians and providers. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs.

HMOs also typically have lower deductibles the amount you must pay before the insurance coverage kicks in than PPOs according to a 2011 analysis of health care plans by Consumer Reports. 1 PPO is short for Preferred Provider Organization and allows patients to choose any physician they wish either inside or outside of their network. In exchange for that added flexibility and decrease in negotiations for specialized care PPO plans require a higher monthly payment.

However a PPO plan allows a patient to see whichever provider they choose even if they are out-of-network. Cost On average HMO members can generally expect to pay lower premiums than members of PPO plans. In fact the difference between an HMO and a PPO could be a couple of thousand dollars in premiums over the course of a year Giordano says.

The acronym PPO stands for Preferred Provider Organization. 5 rows HMO Versus PPO. The first is the structure which is either a public or a private entity.

When you get health insurance youll have to pay a monthly premium just to access the plan. You can also expect to pay less out of pocket. In an HMO plan you have the least flexibility but will likely have the easiest claims experiences since the network takes care of putting in the claims for you.

5 rows HMO plans typically have lower monthly premiums. HMOs generally cost less. There is no mandatory Primary Care Provider and you can see specialists that you choose without needing a referral.

If you travel outside your HMO plans service area frequently your health-care services other. An HMO plan typically does not cover services rendered by doctors who are not involved in the organizations network. PPO Vs HMO Find Your Best Fit.

PPOs do have a list of providers who accept their insurance but youre not assigned a primary care provider or required to get a referral. Under HMO plans you have to pay 100 of the cost to see a provider who is out of network unless its a full-blown medical emergency or there are literally no other options. Primary care physicians HMO plans generally require members to utilize a primary care physician PCP while PPO plans typically do not.

An HMO is like a medical subscription to a hospital system or dental network. If you dont like the doctors and hospitals in your PPO plans preferred. While certain types of plans have higher premiums PPO plans for example generally have higher premiums than HMOs the exact costs of your health plan will depend on the specific plan the insurance provider and your location.

There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan fees. What to Expect When You Join an HMO. You must choose from list of providers.

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

What Is The Difference Between An Hmo And A Ppo

Pros Cons And Comparisons Hmo Ppo Cdhp Part 4 Hoopayz Best Health Insurance Healthcare Plan Health Insurance Coverage

What Is A Ppo About Ppo Health Insurance Medical Mutual

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

Ppo Vs Hmo Insurance What S The Difference Medical Mutual Health Insurance Plans Medical Dental Insurance

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Understanding The Difference Between In Network And Out Of Network Provider Coverage

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

The Facts About Ppo Hmo Ffs And Pos Plans Independent Health Agents

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Or Ppo Or Senior Supplement What S The Difference Arizona State Retirement System

Hmo Vs Ppo Select The Right Plan For Your Employees

What S The Difference Between An Hmo And A Ppo Healthmarkets

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Comments

Post a Comment